As Consumers’ Monthly Debt Loads Increase, Auto Lenders Must Adapt to Manage Risk, Increase Originations

A new TransUnion (NYSE: TRU) study released today found that consumer affordability challenges and tighter lending restraints are impacting new vehicle originations across the auto industry.

The study, Originating Auto Loans With Confidence, explored trends in auto originations, consumer savings, debt burdens and credit scores in the pandemic era, as well as in the years before and after. The study also looked at consumer performance in the auto market, particularly at a time when overall consumer performance is beginning to see some measure of deterioration. In addition, the study explored potentially valuable credit models that may offer lenders an opportunity to increase slumping originations in a risk-appropriate manner.

With the exception of a brief post-lockdown spike in 2021, auto lenders have seen consistent year-over-year (YoY) declines in auto originations in the quarters since the start of the pandemic period. Supply shortages fueled these declines in 2021 and 2022. However, as inventories have normalized, affordability and increasingly squeezed consumer budgets have now become the driving factors in a continued sluggish auto origination market.

“Just as auto inventories began to recover from the worst of the pandemic era supply chain shortages, elevated inflation and higher interest rates that followed have put consumers in a tight financial bind,” said Jason Laky, executive vice president and head of financial services at TransUnion. “As a result, many have been taking on additional and larger monthly payments each month to service higher debt levels. This has likely contributed to some consumers holding off on buying or leasing a new auto.”

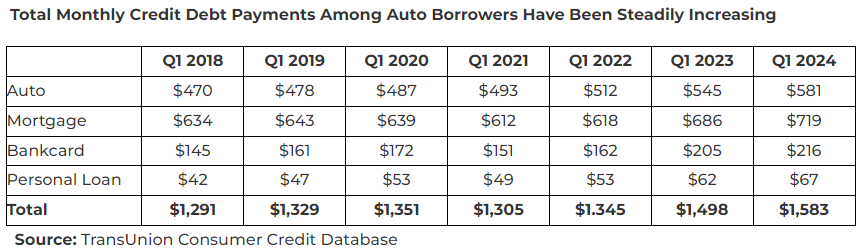

When examining the current monthly debt burden of consumers with auto loans, the study found that the average monthly debt for those consumers increased by nearly 20% over the past two years, with average monthly debt payments increasing steadily between Q1 2022 ($1,345) and Q1 2024 ($1,583). This is nearly double the CPI growth that occurred over the same period.

The study also found that delinquencies are on the rise among auto borrowers. This is likely in no small part due to the increased debt load mentioned above, along with the broad effects of inflation. Auto delinquencies 60 or more days past due (60+ DPD) increased to 1.33% in Q1 2024, up from 1.19% one year prior. The study also found that those consumers who saw the highest credit score migration increases in the 2022 period were at the greatest risk of falling 60+ DPD at least once in the following 15 months. The term credit score migration is applied to consumers who had traditionally found themselves with a higher or lower credit score yet saw their score uncharacteristically increase or decrease over the course of the period mentioned above.

Among Q3 2022 originations, those consumers who were high migrators, or saw significant score increases, in the period prior to their origination were significantly more likely to fall 60+ DPD in that 15-month period following. Among that group, 4.36% fell 60+ DPD during that time period, compared to 2.34% of low migrators and 2.11% of negative migrators.1 This has been a driving factor in the tightening of underwriting standards among auto lenders, and three consecutive YoY originations declines from Q4 2021 to Q4 2023.

“As we are continuing to see auto payments steadily increasing faster than incomes, this is placing pressure on consumers across the credit risk ranges when controlled for risk tier, but in particular, among consumers with below prime credit,” said Satyan Merchant, senior vice president of auto and mortgage line of business leader at TransUnion. “This is something that bears continued monitoring by lenders, and those lenders should consider making further adjustments, potentially through the use of alternative and trended data, as necessary.”

Merchant continued, “While in normal times it may suffice for auto lenders to continually monitor their underwriting risk models for stability and accuracy, in a more unsettled lending environment, such as that in which we find ourselves today, that may simply not be enough. Lenders should consider additional measures to stimulate originations more confidently and maintain growth. These measures can include conducting retrospective and lost sales analyses, tracking and monitoring performance across sample populations, and overlaying blended scores to create dual score strategies.”