By Joseph (Joe) Brancucci, EVP CU Results at CU Strategic Planning

Maria waits in her car outside the credit union, rehearsing what she’ll say. She has the paperwork, the pay stubs, the hope. What she doesn’t have is confidence that anyone inside will see the person behind the numbers. When the loan is declined, she nods politely, thanks the lender, and drives away in silence — one more member who came believing and left invisible.

The Wake-Up Call

She is one of millions. Our lending systems were built for a world that doesn’t exist anymore, they were designed for people with W-2s and tidy credit histories.

Think about the last time a borrower quietly disappeared after being declined. They probably didn’t complain or call a board member. They just left; drifted away without a sound. Then the next time they need a loan, they’ll tap an app that approves them in seconds, speaks their language, and offers not a rate but a solution. That’s the real danger.

We often say lending is about protecting the cooperative, about preserving safety and soundness. But safety for whom? For regulators? Our own balance sheets? For the member who just got turned down, that means nothing. That’s when the trust gap opens and will be almost impossible to close. When members no longer trust us, they stop listening. When they stop listening, they stop belonging.

The Process is the Problem

A consumer loan now requires more documentation than a mortgage did twenty years ago. Borrowers are asked to prove and re-prove that they are who they say they are. A small-business loan file could double as a training manual for auditors. Meanwhile, the market has moved on.

Fintech firms are not just issuing loans; they are rewriting expectations. They understand that no one wakes up in the morning wanting a loan. People want what the loan makes possible, whether it’s a car that starts every morning, a first home, or relief from the anxiety of credit card debt. Fintechs have learned to sell the outcome, not the paperwork. Their processes are digital, quick, and transparent. Most of all, they feel personal.

Digital expectation has become generational instinct. TransUnion’s 2024–2025 generational study found that millennials now represent over half of new originations with fintechs leading the growth. Digital-first borrowers were twice as likely to describe their experience as “easy” or “personal.” Two-thirds of borrowers under forty expect to complete the entire loan process on a phone.

That is the real wake-up call. Our lending policies and processes aren’t simply outdated, they are exclusionary.

3 Shifts

The future of lending will not belong to institutions that cling to tradition, but to those willing to trade comfort for courage. We don’t need more relevant credit unions; we need more compelling ones. Becoming compelling begins with three shifts.

1: From Product to Purpose

Credit unions love products. We measure them, promote them, and compare them as if members were buying lawnmowers instead of making life decisions. We can recite the numbers, but no one wakes up dreaming about interest rates. They dream about a car that gets them to work, a safe home, or a chance to start fresh. Fintechs are selling outcomes, while we’re still selling math.

Rocket Mortgage does not sell debt; it sells belonging. Its advertisements do not mention rates; they show families opening the door to a first home.

2: From Policy to Possibility

If you want to know how inclusive a credit union really is, skip the marketing and read the loan policy. That is where the truth lives. Thin credit files, nontraditional income, or immigrant histories often hit a wall because of habit, not risk.

Others are showing what’s possible. Mission Asset Fund in San Francisco turned informal lending circles into recognized credit products, and the average participant’s credit score rose by 168 points. Companies like TomoCredit and Upstart evaluate potential through education, employment and consistency rather than a single score.

If we believe people come before profit, it must be visible in our underwriting.

3: From Control to Empowerment

Every loan process today is a test of user experience. Members are not comparing us to other credit unions; they’re comparing us to the apps that define their daily lives.

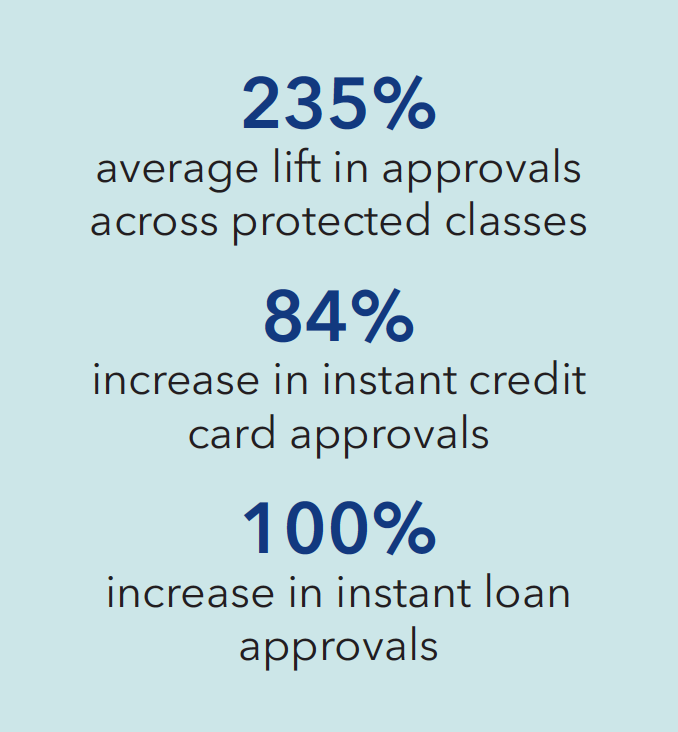

Some credit unions are showing what happens when empowerment replaces control. Verity Credit Union in Seattle worked with Zest AI to automate and modernize underwriting. Auto loans doubled, personal loans grew by 69 percent, and approval rates for seniors, women, and communities of color climbed dramatically. That is not a technology story; it is a mission story.

Empowerment shifts the role of lender from gatekeeper to guide.

Be Compelling

For a long time, being relevant felt like success, but in today’s world where every option is one tap away, relevance simply means we are tolerated. Compelling institutions are chosen. They command loyalty because members feel seen, trusted, and believed in.

Fintechs understand this instinctively. They talk about identity, ease, and belonging — not interest rates. They sell the future, not the fine print.A Call to Action

The credit union movement was never created to be safe. It was created to be bold. From its beginning, it existed to serve the people the system ignored: workers, immigrants, families who were told ‘no’ elsewhere. Lending was never just a financial service; it was a declaration of trust and community.

That spirit still matters. Fintechs have rewritten expectations, but they have not claimed our purpose. Within the next ninety days, every credit union leader could take two steps:

- Remove one outdated policy that no longer reflects the way members live.

- Create one new offering that delivers transformation rather than transaction.

The future of lending is not about moving money. It is about moving lives.

This blog is an excerpt from Joe’s Executive Insight Report for CU Results, the consulting division of CU Strategic Planning. The complete report, including a leadership workbook, is available here so you can begin your journey toward compelling today.

1 thought on “3 Shifts Credit Unions Must Make on Their Journey Toward Compelling”

From Product to Purpose…. that is how I feel about Fin Edu in CU’s…. we have been pushing products….encouraging everyone to go into a digital solution and APP o get an AI coach and figure it our on their own. Economies of scale, I think we call it to make ourselves feel good about it but where is the measurable change in behaviors, where are outcomes, and changed lives? Do these solutions feed the cooperative in ROI…. more products per member? healthier loan portfolio because of improved credit scores? More loan ready? Less delinquencies? I think the PURPOSE of fin edu should be baked into all of the processes… we are “selling money” after all…. if that is not relational, I am not sure what “sale” would be.