Are we ensuring everyone else knows?

WalletHub just dropped its Q4 2025 Banking Landscape Report, and if you’re a credit union executive, you should print this one out and hang it in the break room. Because the data doesn’t just show credit unions are competitive; it shows they’re absolutely dominating on the metrics that actually matter to consumers.

Let’s break down what WalletHub found in its analysis of over 3,300 deposit accounts from banks and credit unions across the country.

The Interest Rate Beatdown

Here’s the headline that should make every bank CEO nervous: Credit unions offer checking account interest rates that are 60 times higher than regional banks.

60X

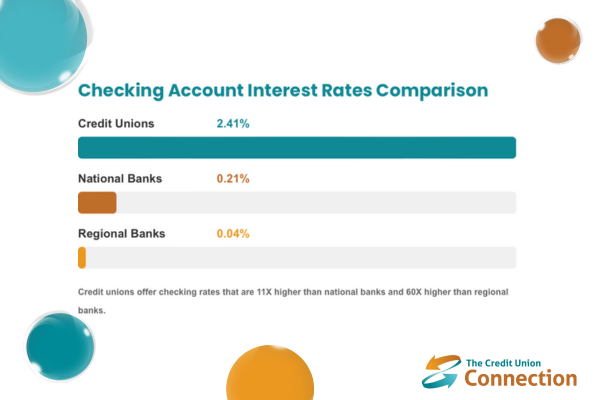

Credit unions average 2.41% on checking accounts while regional banks limp along at 0.04%. You read that right.

The comparison to national banks isn’t much better for the big guys. Credit union checking rates are 11 times higher than what you’ll get from institutions with national footprints (which average just 0.21%).

Checking Account Interest Rates Comparison

Credit unions offer checking rates that are 11X higher than national banks and 60X higher than regional banks.

Credit unions are 11X better than national banks

Credit unions are 60X better than regional banks

Credit Union Rate Advantage

But wait, there’s more. On the savings side, credit unions are still winning with an average interest rate of 1.19%—more than double what you’ll get from national banks (0.46%) and more than three times better than regional banks (0.34%).

Even community banks, which are supposed to be the friendly alternative to megabanks, can’t compete. Their average savings rate is a pathetic 0.18%.

The Fee Advantage Nobody Talks About Enough

Interest rates get all the attention, but let’s talk about fees—because this is where credit unions really flex.

According to WalletHub’s Fee Index, credit unions are 44% cheaper than the next-best option (small banks). They’re 76% less expensive than national banks.

Let that sink in. If you’re banking at a national bank instead of a credit union, you’re paying nearly four times as much in fees for the privilege.

Average Annual Checking Account Fees

WalletHub Fee Index – Lower is Better

Unions

Banks

Banks

Banks

Banks

Credit unions are 76% less expensive than national banks and 44% cheaper than the next-best option.

The monthly fee situation tells a similar story. Credit unions average just $1.54 in monthly fees compared to $15.04 at national banks. And here’s the kicker: 79% of credit union checking accounts charge zero monthly fees with no minimum balance requirements. Only 20% of national bank accounts can say the same.

Out-of-network ATM fees? Credit unions average $0.83 while national banks hit you with $2.04. And 52% of credit unions reimburse ATM fees entirely, compared to just 39% of national banks.

The Features Gap Is Real

WalletHub created a “Features Index” to measure features such as zero-fee accounts, ATM access, interest-bearing accounts, and rewards programs. Credit unions scored 51.85% while national banks managed just 35.65%.

More specifically:

- 63% of credit union checking accounts are interest-bearing vs. just 36% at national banks

- 47% of credit unions charge zero out-of-network ATM fees vs. 28% at national banks

- 51% of credit unions require zero minimum deposit to open vs. 56% at national banks (okay, banks win this one)

Interest-Bearing Checking Accounts

Credit union members are 75% more likely to earn interest on their checking accounts than national bank customers.

But here’s the stat that really matters: 82% of credit union checking accounts charge no monthly fee with no minimum requirements. At national banks? Just 20%.

What Consumers Actually Think

WalletHub also surveyed over 200 Americans about their banking habits, and the results should worry traditional banks.

51% of people plan to open a new bank account in the next 12 months. That’s half the country actively looking to switch or add accounts. And with credit unions offering 60X better checking rates and 76% lower fees than national banks, where could that money be heading?

The survey also revealed some troubling signs for the banking industry:

- 35% of Americans believe their bank is taking advantage of them

- 60% say the money in their bank accounts isn’t keeping up with inflation

- 56% aren’t satisfied with their interest rates

- Only 57% describe their primary bank account as “fine” (with just 39% saying “great”)

When asked what’s holding people back from trying a credit union, the top answer was “unfamiliarity” (38%), followed by concerns about ATM/branch access (28%). These are perception problems, not reality problems—and they’re solvable.

Interestingly, 58% of Americans now trust online-only banks, which suggests the “I need a physical branch” objection is fading fast. Credit unions that have invested in digital experiences are well-positioned to capitalize on this shift.

The Regional Reality Check

WalletHub broke down the data by region, and some interesting patterns emerged. The Southeast offers the best checking account interest rates (2.27% average), while the West languishes at just 0.07%.

Credit unions in the Midwest and Southeast are crushing it on rates, while Western consumers are getting fleeced. If you’re a credit union operating in the West, you have an opportunity to highlight just how much better your rates are than the regional competition.

On the fee side, the Northeast has the lowest average checking fees ($29), while the Southwest pays the most ($41). But across every region, credit unions consistently outperform banks on both rates and fees.

The CD Situation

One area where credit unions face real competition: CDs. While online savings accounts offer an average APY of 3.12%, 1-year CDs average just 2.91%, making them a tougher sell.

However, credit unions still win on CD rates compared to traditional banks:

- Credit union 1-year CD: 3.37%

- National bank 1-year CD: 0.84%

That’s a 4X difference. Even with online savings accounts offering competitive rates, credit unions are giving consumers better options than big banks across the board.

The Business Banking Blind Spot

Here’s a sobering stat for credit unions: Business checking accounts are terrible across the board.

WalletHub found that business checking accounts are 2X more expensive than branch-based personal checking and 6.5X more expensive than online personal checking. They also offer 80% lower interest rates and have 67% fewer features.

The report’s advice? “Small business owners who aren’t looking for business-specific features should gravitate to personal banking options whenever possible.”

This is both a challenge and an opportunity for credit unions. If you can offer business checking that doesn’t gouge small business owners, you’ve got a competitive advantage.

What This Means for Credit Unions

The WalletHub data confirms what credit unions have been saying for years: the cooperative model delivers better value for consumers. Period.

Credit unions are 60X better than regional banks on checking rates. They’re 76% cheaper than national banks on fees. They offer more features, fewer gotchas, and better member experiences.

The challenge isn’t performance—it’s awareness. When 38% of people say “unfamiliarity” is what’s holding them back from trying a credit union, that’s a marketing problem, not a product problem.

With 51% of Americans planning to open a new account in the next year, and 35% believing their current bank is taking advantage of them, the opportunity is massive. Credit unions must ensure people know they exist and that they’re literally 60 times better than regional banks.

The data are on your side. Now tell that story.

How does your credit union stack up against these benchmarks? Share your rates and fees in the comments.