The Defense Credit Union Council (DCUC) continues to urge Congress and the White House Administration to reject the Durbin-Marshall credit card mandates, warning the proposal would expand a failed regulatory framework that harms consumers, small businesses, and community financial institutions while delivering a windfall to the nation’s largest corporate retailers.

The mandates would extend the original Durbin Amendment’s routing requirements to credit cards, despite clear evidence that similar policies failed to benefit consumers. According to the Government Accountability Office, absent the original Durbin amendment, 65 percent of noninterest checking accounts at covered banks would have been free. Instead, consumers experienced reduced access to free accounts, fewer benefits, and higher costs. Expanding this approach to credit cards would similarly reduce access to credit, eliminate popular rewards programs, and increase fraud risks.

“These mandates repeat the same mistakes that consumers already paid for under the original Durbin amendment,” reminds Anthony Hernandez, DCUC President/CEO. “A one-size-fits-all rewrite of the credit card payments system would reduce access to affordable credit, weaken fraud protections, and disproportionately harm servicemembers, veterans, and working families who depend on secure, reliable financial services.”

Lower-income and minority consumers would be hit hardest. Notably, 77 percent of cardholders earning under $50,000 carry a rewards credit card—benefits that would be jeopardized under the Durbin-Marshall proposal.

Independent analysis reinforces these concerns. Oxford Economics estimates the bill could cost the U.S. economy $228 billion and eliminate 156,000 jobs by undermining rewards programs that support travel, tourism, and consumer spending. The Congressional Research Service has also concluded it is unclear whether retailers would pass savings on to consumers. History suggests they would not: following the original Durbin amendment, 98 percent of merchants either raised prices or kept them the same.

Claims that the proposal would increase competition are also misleading. A University of Miami study found nearly all savings would flow to retailers with more than $500 million in annual sales, disadvantaging small businesses while consolidating benefits among corporate megastores. Assertions that community banks and credit unions would be “exempt” are equally flawed. Federal Reserve data show community banks experienced a 30 percent decline in interchange revenue after the original Durbin amendment, despite statutory exemptions—an outcome expected to repeat.

The proposal also presents serious fraud risks. A Texas A&M study estimates the mandates could double card fraud to $20 billion over the next decade while reducing institutions’ ability to invest in fraud prevention, cybersecurity, and data protection. Established card networks invest billions annually in real-time monitoring, dispute resolution, and consumer protections—safeguards that would be undermined by forced routing to alternative networks lacking comparable scale and accountability.

These risks are especially urgent amid ongoing economic uncertainty. Following a recent government shutdown and the possibility of another looming, families face heightened vulnerability. Weakening payment protections during such periods increases the likelihood of fraud losses that consumers cannot afford and that may take months to resolve.

Reflecting broad, bipartisan concern, the American Bankers Association, America’s Credit Unions, the Association of Military Banks of America, the Bank Policy Institute, the Community Development Bankers Association, the Consumer Bankers Association, the Defense Credit Union Council, the Electronic Payments Coalition, the Independent Community Bankers of America, and the National Bankers Association issued the following joint statement after President Trump expressed support for the Durbin-Marshall credit card mandate:

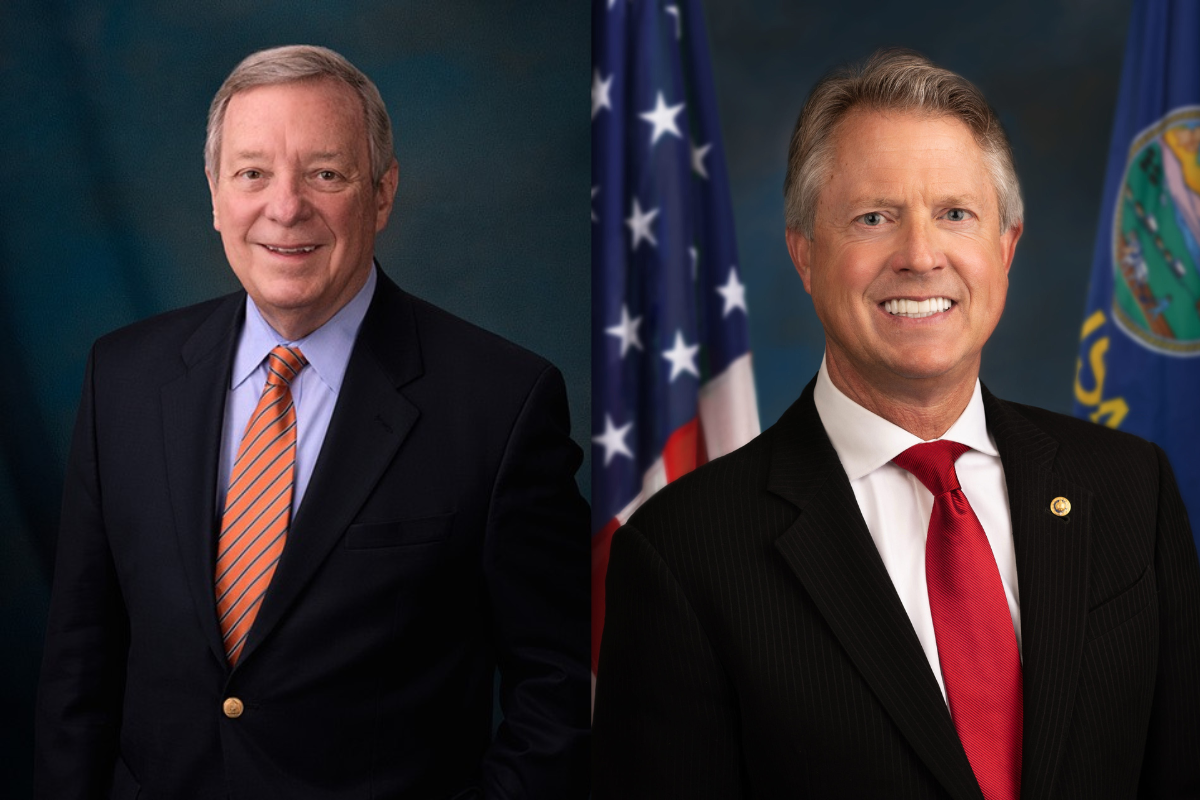

“One surefire way to make life less affordable for Americans would be to pass the misguided Durbin-Marshall credit card mandate, which would harm consumers, small businesses, and the community financial institutions that drive local economies. Lawmakers have rightly rejected past attempts at legislation and amendments to mandate the reengineering of the nation’s trusted, resilient, and efficient credit card payments system just to boost the profits of the nation’s largest retailers. This Congress should again reject this harmful proposal. Anyone supporting Durbin-Marshall is voting to make credit card transactions less secure and to take away the credit card reward programs that make life more affordable for millions of Americans.”

Credit union leaders also stress that large retailers should invest more aggressively in fraud prevention and partner with financial institutions to strengthen safeguards, rather than shifting risk onto consumers while preserving guaranteed savings for themselves.

“The Durbin-Marshall credit card mandates would benefit corporate megastores at the expense of America’s consumers, small businesses, and community financial institutions. Congress should reject this proposal in any form and instead pursue policies that strengthen consumer protection, preserve access to credit, and safeguard the integrity of the U.S. payments system,” says Hernandez.

“America’s Credit Unions has long opposed the Credit Card Competition Act because it would disrupt a secure and competitive credit card system in ways that hurt consumers and small financial institutions, while benefiting Big Box retailers. The bill’s routing mandates will ultimately lead to increased fraud, reduced card rewards, and limited access to affordable credit for millions of credit union members. There’s no evidence this proposal would lower prices for consumers, but there is evidence this will benefit the largest retailers in the United States. The real risk is that it would weaken the payments system people rely on every day. Credit unions urge lawmakers to reject this approach and focus on policies that support a strong payments system while protecting consumers and financial choice.” said Scott Simpson, President/CEO

DCUC respects and supports the President’s stated goal of improving affordability and expanding financial opportunity for American families.

“Credit unions share this mission and have long been trusted partners in promoting financial well-being through responsible lending, personalized programs, and specialized services for America’s communities,” says Hernandez. “DCUC stands ready to work with the Administration and Congress to provide data, expertise, and workable solutions that advance affordability objectives without undermining access to safe, affordable credit or weakening the financial stability of military families, working-class households, and underserved communities.”

“America’s Credit Unions has long opposed the Credit Card Competition Act because it would disrupt a secure and competitive credit card system in ways that hurt consumers and small financial institutions, while benefiting Big Box retailers. The bill’s routing mandates will ultimately lead to increased fraud, reduced card rewards, and limited access to affordable credit for millions of credit union members. There’s no evidence this proposal would lower prices for consumers, but there is evidence this will benefit the largest retailers in the United States. The real risk is that it would weaken the payments system people rely on every day. Credit unions urge lawmakers to reject this approach and focus on policies that support a strong payments system while protecting consumers and financial choice.” said Scott Simpson, President/CEO