Nearly three-quarters of bankers fear economic recession in the U.S. is either already here or we will enter one within the next year, according to a survey of more than 400 bankers released today by fintech IntraFi.

Ten percent of bankers said the economy is already in recession, while another 24% predicted it would happen within the next six months. Bankers listed several areas of concern, including 52% who cited interest rate uncertainty, 39% who foresee potential credit quality deterioration and 38% who raised the possible negative economic impact from new U.S. tariffs.

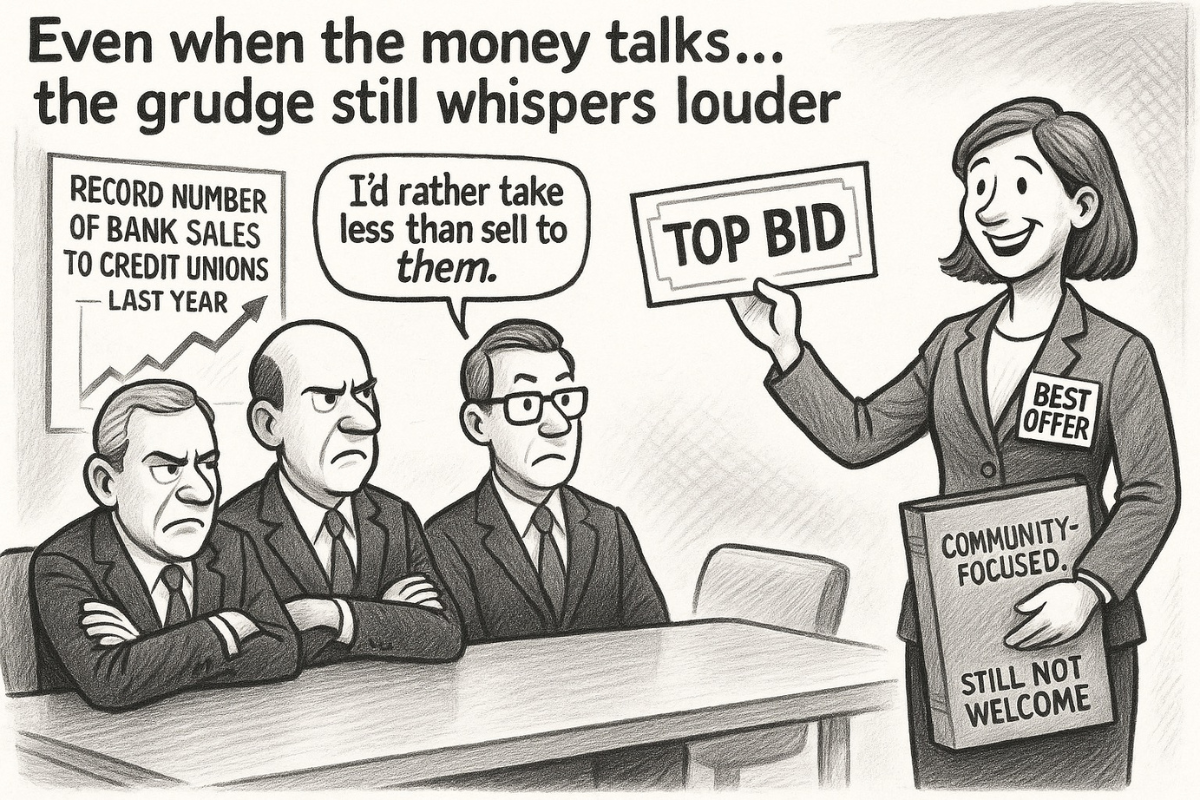

The survey also underscored the ongoing antipathy banks have for credit unions. Despite a record number of banks being acquired by credit unions last year, 55% of those surveyed say that if their bank were up for sale, they would not sell to a credit union, even if it was the best offer.

“Bankers are increasingly nervous that a recession will happen soon,” said Mark Jacobsen, CEO and Cofounder of IntraFi. “The uncertainty around a number of key economic issues is driving that fear.”

Bankers’ expectations for overall economic conditions over the next year reflected their growing fears of a recession. Since the last quarterly survey, there was a 24 percentage-point increase in bankers who expected overall economic conditions to worsen.

Asked specifically about the impact of new tariffs on bank customers, 12% said they would have a significant negative impact, while 59% said they may create moderate challenges for customers in industries like manufacturing, agriculture and retail. Twenty-two percent said they would either have no direct impact or only a minor impact, while 7% said new tariffs could benefit some customers by encouraging domestic production.

Other Highlights

- Loan Demand is softening. The percentage of respondents who anticipate loan demand to increase in the next 12 months dropped 16 points from the previous quarter to 39%.

- Funding Costs will decrease over the next year according to 67% of respondents.

- Deposit Competition held steady or increased according to over 80% of respondents, with 88% anticipating it to increase or stay the same in the year ahead.

- Access to Capital remains constant. The number of bankers (75%) who believe it will remain the same for the next year was identical to the number who said so in the final quarter of 2024.