By Sarah Snell Cooke, founder/CEO, The Credit Union Connection

If you want to know what credit union leaders are really thinking—not the polished keynote version, but the honest, unfiltered version—get yourself to The Underground.

This year’s Underground Collision of Contrasts, which led into Money 20/20, delivered panel after panel of credit union CEOs, industry veterans and forward-thinking executives who weren’t afraid to talk about the messy, complicated reality of running a financial cooperative in 2025.

From the existential questions about mergers and identity to the practical challenges of teaching your staff to use data, these leaders covered it all with real stories, bold opinions and actionable insights.

Collaboration: Credit unions’ true superpower

“There’s two big players in the mortgage servicing area. Nobody likes them, but we almost all exclusively use them. Why couldn’t we do this ourselves?” -Keith Sultemeier, CEO, Kinecta Federal Credit Union

Keith Sultemeier, CEO of Kinecta Federal Credit Union, opened strong with a reminder of what makes credit unions different: “Our long-term superpower has always been collaboration among ourselves, even in the same markets we tend to share, right? And this is unique to any industry I’ve ever been in.”

He traced this back to the origins of CUSOs, explaining how credit unions banded together when they were “either ignored or taken advantage of as smaller players.” The result? “When we combine together, we find that we’re a hell of a lot stronger, can negotiate better deals, can be taken seriously.”

His challenge to the industry was direct. “There’s two big players in the mortgage servicing area. Nobody likes them, but we almost all exclusively use them. Why couldn’t we do this ourselves?” he questioned.

And that’s fair to ask. Credit unions have done this before with CU Direct (now Origence) and others. Why not now?

Caroline Willard, CEO of Cornerstone League, agreed, tying it back to member centricity: “It’s curiosity and learning and getting into the new spaces, but understanding that customer centricity. At the end of the day, who we are really here to serve, and how their interest is fulfilled, whether through mergers or acquisitions or new markets.”

Credit union-fintech partnership reality check

Curql CEO Nick Evens dropped some truth bombs about what the fintech investing fund was looking for when it made an investment.

“You must care. You must care about the future of the credit union industry, the future of credit unions, and, more importantly, taking care of the member.”

But that’s not enough. Evens explained that Curql isn’t a typical venture capital firm. “A venture capital firm will say, ‘here’s some money. Take it and run. Grow, grow, and then call us when you’re returning our money 10x and exiting the market.’ In our case, if a fintech exits the market, our credit unions lose a partner.”

Curql is not investing to see companies exit and technology get shelved. When Amount was sold to FIS, Evens noted, “We’re keeping an eye on them, and Amount is making sure that they’re continuing to serve the credit union industry the way they were before.”

The cautionary tale? Payrailz, which was purchased by Jack Henry. “We’re all on record as saying we don’t like the outcome there… because they hurt the credit unions by basically taking that payment rail away.”

At the end of the day, Evens wants to see these companies become part of the fabric: “Hopefully we can create a super CUSO or distribute those shares… that company stays alive and continues to serve the credit unions.”

The labels we force on everyone (including ourselves)

Strategic Advisory Solutions Principal Dr. Brandi Stankovic delivered what might have been the most unexpectedly profound moment of the conference, pivoting from credit union operations to talk about parenting and Neanderthals.

Stick with us.

She talked about raising kids in “a culture of labels” where everyone must fit into neat categories: “Are they shy? Are they bossy? Are they genius? Are they troublemakers?” Kids are told to “pick a sport, pick a lane, honors or special needs, athlete or artist. Brand yourself by the age of 12.”

Her advice to her own kids? “You’re allowed to be thoughtful and fast.

You’re allowed to be loud and kind. You can be the hurricane and be the structure of the harbor. You don’t have to label in order to fit in.”

Then she brought it home with a podcast reference about Neanderthals: “Maybe being a little weaker is what made us smarter… Maybe evolution didn’t reward the loudest or the strongest. It rewarded the ones who cooperate, communicate and come together.”

Her underground message: “Progress isn’t about embracing what came before. It’s about integrating instinct and intellect together, grit and grace together, ego and empathy and edge all together.”

In other words, stop trying to be one thing. The collision of contrasts is the point.

The credit union merger question

Border Federal Credit Union CEO Maria Martinez addressed the elephant in the room. “Should we all just merge together into big credit unions? Or do small credit unions belong in our industry?”

Her answer was nuanced. “Mergers are going to happen,” she acknowledged, “but you’ve got to be really careful, because when you’re looking for another credit union that you can merge into, or they can merge into you, you have to make sure that there’s a culture match.”

She admitted Border FCU has looked at mergers, but “one of the main reasons we didn’t merge was because the culture was not going to be there… You have to look out for your members. What is it that they’re expecting from your programs?”

Martinez paralleled founding the National Association of Latino Credit Unions and Professionals (NLCUP) and the Credit Union Women’s Leadership Alliance (CUWLA) to building member trust. The crux was building safe spaces and extending that to members, concluding, “Your members are looking for that safe space when they come to you.”

When asked why America First decided to buy Meadows Bank, CEO Thayne Shaffer explained they’d gone through a strategic planning process to define exactly what would make sense.

The key factors? “We found a willing partner who had an operation that was very similar to ours…Our cultures were very similar, which is one of the biggest challenges to any merger.”

He continued, “We saw an opportunity to bring in incredible talent, great leadership, and a team that had existing relationships in an area that we were struggling to build a team in.”

The data literacy problem nobody wants to talk about

“We need a high degree of data literacy in our staff, right?” Navy Federal Credit Union Dietrich Kuhlmann stated honestly. “They’re not yet there. They don’t yet understand how they can leverage data to be more effective for our members, or more effective in their jobs.”

And, their resistance is real, he pointed out. “There’s fear of the unknown. And to be frank, I think there’s some fear about, well, this is just going to replace me.”

“What I’m trying to explain to them,” he said, “is the future worker is going to leverage these tools, whether here or somewhere else. Let us upskill you so that you have these skills. If you don’t stay with us, you still have the skills, and you can take them elsewhere.”

It’s a generous approach, but Kuhlmann admitted: “I underestimated the lift there, but it’s one that has to happen.”

The ecosystem challenge: You can’t do everything alone

When the conversation turned to bandwidth and technology evaluation, Nick might have captured what every small- to mid-sized credit union feels. “Many times, credit unions just don’t have the bandwidth. They just don’t have the wherewithal, the number of people, or the skill sets inside the organization to evaluate a lot of this technology that’s coming at them.”

Outsourced and fractional roles can be a great solution. “There are topics today around outsourced CFO, CIO, CTO, fractional-type roles. That’s the kind of work that we need to do together in the industry.”

Shazia Manus, Chief Data and Analytics Officer at TruStage, emphasized the need for genuine ecosystem collaboration: “System is only a system when there’s trust, there’s standards, unity, whether it’s voice or standards, and then scale toward a common direction. Individual sticks are vulnerable, breakable, but sticks in the bundle is unbreakable.”

Keith’s ‘Top Gun’ school for fintechs

Perhaps the most memorable quote came from Keith with advice for potential fintech partners.

“Don’t write checks in the sales process that you cannot cash after implementation. We have long memories.”

And,

“Don’t make me feel like the prettiest girl at the dance in that process and then ghost me. This ecosystem is very tight. We talk to each other.”

His point? “If you do a great job for one, others are going to hear about it. If you do not do a good job for one, others are going to hear about it.”

Caroline tied everything together by calling back to credit union history: “There is a history of collaboration in our movement. Origence, you mentioned, there’s another example. I think we’re looking for that next big thing… something that will propel our movement forward, that’s relevant, it keeps us in the game.”

Her challenge, “We are better when we collaborate and when we aggregate our buying power.”

When the big guys get big honest

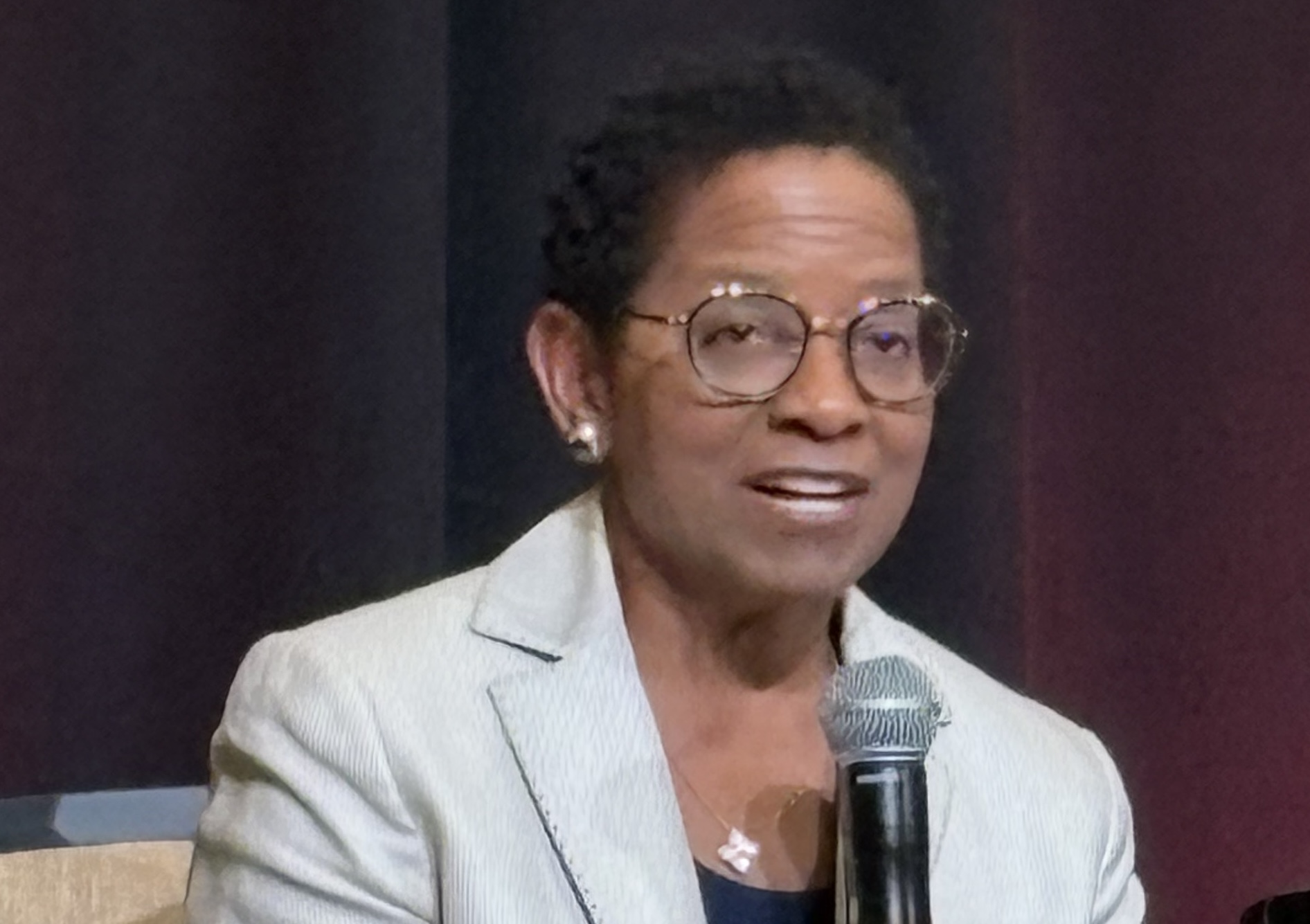

The Unrivaled CEO Panel brought together Dietrich (Navy Fed), Bill (SchoolsFirst), Leigh (SECU), Beverly (BECU), Sterling Nielsen (Mountain America CU CEO), and Thayne (America First Credit Union).

Despite representing billions in combined assets and millions of members, they were clear that their size does not change their mission to serve their members.

Dietrich set the tone. “We do not want to make this journey alone – a large credit union is still a credit union. It’s a credit union in how it’s run and operated, with members being first. Our motto is, ‘our members are the mission.’”

Bill emphasized member service: “It’s one thing for us to be here as CEOs, and it’s an honor to serve our credit unions, but it’s the team that serves our members.” He noted Schools First has worked with Gallup for almost 10 years on both member engagement and team member engagement. Why? Because “If our team is disengaged, they’re not going to have the mindset…to help our members with their own financial wellbeing.”

Financial Education: It’s non-optional

When the conversation turned to financial literacy, Beverly made a crucial point: “You think about big disciplines in our life, whether it’s driving a car, we have to learn how to do that… but when you think about one of the most important disciplines that we carry through all of our lives, financial management, money management, we don’t teach that.”

She shared BECU’s loan reprice program, running for 20 years. “As we teach people how to manage their credit, if they do a really good job, every year, we’ll reprice certain of their loans,” Beverly shared. “We’ve done 650,000 of those loans at $29 million of savings to members right into their pockets.”

Leigh said regarding financial education, “We believe you start early and often, and that is going to make for a successful member and citizen moving forward.”

Thayne noted the evolution: “When I first started, it was all about teaching at the high school and teaching them how to write a check.” Now? “We get calls from universities. We get calls from community groups… Everybody recognizes the need for whoever their constituency is to have a better financial education.”

Tech decisions that matter

Responding to a question from host Susan Mitchell of Mitchell Stankovic and Associates, Beverly explained that after attending a Harvard Business School conference where a professor said leaders not focusing on AI were “probably behind,” she accelerated BECU’s strategic plan. BECU bought EarnUp, an AI fintech the credit union was already partnering with on debt management.

She added, “There’s got to be a scalable way to deliver that financial journey, and we think the way to do that is through a financial advisor, generative AI, that will deliver this kind of help at scale that our member consultants do every single day.”

Beverly acknowledged, “At first, they were a little bit leery, like, ‘Oh my god, I’m going to lose my job.’ But then we started talking about all the ways AI can help take some of the pain of their work every day off their plates… We call it no-joy work.”

Navy Federal, according to Dietrich, “has been on a five-year journey to get our data basically cutting edge.” Now, “every vendor or partner that comes in to work with us… they want to work with us because of how good our data infrastructure is.” This step is crucial.

Dietrich added his credit unions is also moving toward real-time banking.

Trust: The foundation of everything

Sterling shared a travel horror story about Delta’s system failure that left him without a boarding pass or PreCheck. His point? “I can say this was the airline’s fault. Well, … a vendor created that problem… but regardless, it’s Delta’s fault.”

And it’s the same for credit unions.

“Trust is critical in what we do. When we have an offering from one of our trusted partners, we need to have it work. It needs to work right as advertised. It needs to be flawless, because it reflects on us.”

Dietrich made a crucial distinction between vendors and business partners. “If we call you a vendor, we’re probably not very happy with you,” he said. “You really want us to call you a partner, which means you’re in this with us. So, it’s more of a covenant relationship than just a contractual relationship.”

Bill expanded the concept beyond vendors. “Trust is the foundation that our entire movement is built upon. The whole people-helping-people philosophy is built on trust, whether with our team, with our members, with our partners, with our regulators.”

While Leigh added that what she wanted was business partners that would help SECU collaborate with and support other credit unions. “I want someone who is going to allow us to help other credit unions and smaller credit unions… I want a partner that’s going to kind of live in that space with us and not just be out to make money in the end.”

Taking a global perspective

Bill brought international scope to the conversation, noting that while the US has the most credit unions by far, “there are credit unions in 104 countries in the world, 75,000 credit unions serving 411 million people.”

His experience traveling with World Council of Credit Unions? “It’s like a time machine, because you can travel back to credit unions in time who are just now getting started in some countries.” But you can also “go into the future and see credit unions who own their own payment system, and they have the banks beating down their door to get on the credit union payment rails. That hasn’t happened in the United States of America.”

Dietrich shared Navy Federal’s global footprint through the overseas military banking program, serving members in North Korea, Japan, Germany, Italy, Bahrain and Djibouti.

“We recently decided to bid and won the bid for the overseas military banking program. It’s a program that moves a lot of money around to help servicemen stationed overseas. So, the credit unions that are over where they are, this program gets money to them and to the exchange and to the commissary, and then it also allows them to participate in that country’s banking system, which they otherwise wouldn’t be able to do. One of our old sayings is, ‘We serve where you serve.’”

The Verdict: What Actually Matters

What runs through every conversation at The Underground isn’t the polished corporate messaging you’d see in a press release. It’s the messy, honest reality of trying to serve members in an increasingly complex world and the acknowledgment that credit unions can’t do it alone.

Collaboration was a consistent theme throughout. From Keith ‘s call for a credit union-owned mortgage servicing solution to Caroline’s reminder that “We are better when we collaborate and when we aggregate our buying power,” the message was clear: credit unions have always been stronger together.

But collaboration isn’t just about forming CUSOs or negotiating better vendor deals. It’s about being honest with each other about the challenges we face. Dietrich, CEO of the largest credit union in the world, admitting his staff isn’t data literate yet. Beverly explaining that BECU employees were initially scared AI would replace them. And, Maria talking about how culture fits in merger conversations.

The labels conversation Brandi led might have been the most critical message of all: Stop trying to be one thing. You can be community-focused and technologically advanced. You can be mission-driven and profitable. You can be small and powerful. The Collision of Contrasts isn’t a problem to solve; it’s the entire point.

This is the kind of honesty that will help move the credit union community forward.

Were you at The Underground 2025? What resonated with you? Drop your thoughts in the comments below.