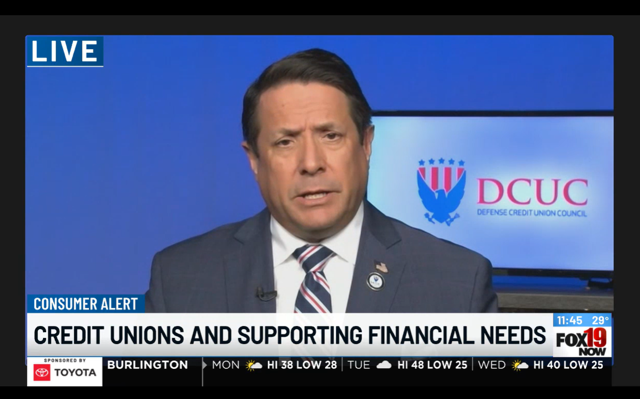

Today, the Defense Credit Union Council (DCUC) participated in a nationwide media tour from the National Press Club in Washington, D.C., featuring President and CEO Anthony Hernandez in interviews with local and regional radio and television outlets across the country.

The broad press coverage included both live and taped segments sharing the vital role credit unions serve in strengthening communities’ financial well-being and advancing consumer-focused, not-for-profit services.

Media participation spanned markets nationwide and included outlets such as WHAS-TV (Louisville), WSNY Radio (Columbus), KARK-TV (Little Rock), KTNV-TV (Las Vegas), WXIX-TV (Cincinnati), WBAL Radio (Baltimore), and KMIR-TV (Palm Springs), among others, with networks including ABC, FOX, NBC, and CBS. Through these conversations, DCUC highlighted how credit unions serve as trusted financial partners, provide access to affordable services, and advocate for policies that protect their ability to serve members, including military, veterans, and underserved or vulnerable communities.

DCUC addressed questions sharing how frequent moves and deployments can disrupt military family budgets and highlighted how credit unions help families stay financially on track through specialized tools such as mobile banking and remote check deposit, early access to pay, deployment-friendly lending, and financial counseling tailored to budget transitions.

DCUC also discussed how credit unions support veterans transitioning from active service to entrepreneurship by offering affordable small-business loans, one-on-one financial coaching, credit-building assistance, and partnerships with veteran organizations that provide education and mentoring.

In addition, DCUC responded to questions about current legislative proposals that could affect how credit unions serve their members, including efforts that would impose government control over credit card operations and potentially weaken security while reducing access to military-specific benefits. DCUC shared that defense credit unions help fund low-interest, no-fee credit cards, deployment relief loans, free financial counseling, and emergency assistance programs, services that could be jeopardized by well-intentioned but harmful legislation.

During a live television segment featured by WTVM in Columbus, Georgia, Hernandez explained:

“With a proposed 10% credit card interest rate cap, and that sounds really good until you read the fine print, that only applies to people with great credit scores. A lot of Americans are still struggling and don’t have great credit scores. And so even though credit unions are capped at 18% interest rate, when you drop it down to 10, you’re going to throw a lot of people off their credit card; [they’re] not going to be able to use them anymore, and that’s a bad thing. You’re restricting access to the financial services market, and you put those people that still have those short-term needs into the arms of predatory lenders, and that’s never good. The other one is the so-called Credit Card Competition Act, and that’s so big box merchants can use cheaper networks. And like I said, cheap networks implies unsafe data compromise; you have a lot of fraud, and any savings that they get, they are not going to pass on to the consumer; they’re going to pocket it…It’s just not good legislation, so we’re against those two things as they affect the American consumer.”

Adding to Hernandez’s remarks, DCUC Chief Advocacy Officer Jason Stverak said, “When policies are developed without a full understanding of their real-world impact, military families, veterans, and working Americans risk losing access to the safe, affordable financial tools they rely on every day. A core part of DCUC’s mission is ensuring lawmakers hear directly how these proposals affect consumers and the credit unions that serve them. We will continue advocating for solutions that preserve security, choice, and the ability of credit unions to meet members’ needs.”

DCUC extends its sincere gratitude to the journalists, producers, and stations that participated in today’s sessions and whose reporting helps ensure the American public remains informed about available financial resources and the real-world impacts of financial policy decisions.

“Sharing the story of credit unions’ impact remains incredibly important. These are institutions that continue to lead an important role within America’s financial service sector as not-for-profit stewards of financial well-being, affordable services, trusted guidance, and stability during uncertain times,” says Hernandez. “I’m grateful to the outlets that took the time to engage today, because their work directly informs the public about the resources available to support them, and when well-intentioned policy proposals could unintentionally limit credit unions’ ability to serve the people who depend on them.”