Michelle Bloedorn, CEO of Member Loyalty Group

As credit unions look ahead to 2026, most are giving more attention to the role that member experience (MX) plays in growth, loyalty and long-term success. Many organizations are gathering more feedback than ever before, but collecting data and acting on it are two very different things. To affect true change, credit unions should start with setting the right goals that motivate teams, reflect the cooperative’s strategy and deliver measurable results.

Member Loyalty Group (MLG), which partners with more than 200 credit unions nationwide, has spent years studying what makes some member experience programs thrive while others stall. The findings reveal that the best programs set goals that are both meaningful and manageable, including:

- Focusing on the right metrics;

- Aligning goals across the organization; and

- Keeping expectations realistic.

Measuring What Matters

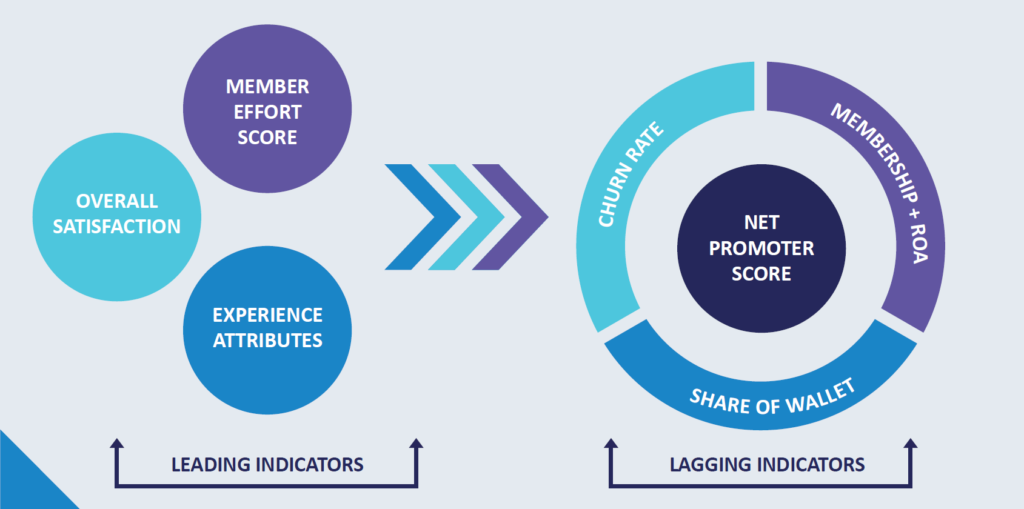

Credit unions can use a range of tools to measure member experience, from Net Promoter Score (NPS) and Overall Satisfaction (OSAT) to Member Effort Score (MES), with each offering a different viewpoint into how members feel and where improvements can be made.

According to our data, Relationship NPS provides a strong indicator of long-term loyalty, while interaction surveys reveal more immediate feedback about specific touchpoints across the branches, contact centers and digital channels.

The most successful credit unions use both. Leading indicators, such as MES or OSAT, offer near-real-time insights that teams can act on quickly, while lagging indicators, like Relationship NPS, reflect the cumulative impact of those daily actions over time. When combined, these metrics help credit unions see both the short-term wins and the bigger picture of member loyalty.

Aligning Goals to Strategy

Research shows that credit unions make the most progress when their MX goals are tied directly to broader business objectives. For example, a credit union focused on expanding into new communities might set a goal around improving branch satisfaction to ensure every new location delivers a consistent, positive experience. Another focused on growing loan portfolios might use MES data to reduce friction in the loan application process.

Aligning goals in this way also helps unify teams and increase engagement as staff at every level understand how their work contributes to member loyalty. Branch managers can track OSAT scores, while executives monitor Relationship NPS, giving everyone ownership of a metric that reflects their influence on the member journey.

Managing Experience Through Change

Many credit unions spend time on setting overly specific or unrealistic targets, but our benchmarking data show that small fluctuations in member experience scores are often not statistically significant. For instance, missing a target by a few hundredths of a point rarely means the MX actually changed, and relying on such narrow numerical goals can demotivate teams and distract from the larger purpose of improving relationships.

Instead, many credit unions are shifting toward percentile-based goals that compare their results to peers of similar size and structure. This approach accounts for industry-wide shifts, such as the temporary score dips that often follow digital banking conversions or other major system changes, while keeping goals relevant even when external factors influence results.

Big initiatives like core conversions or new digital rollouts inevitably affect the member experience, with MLG’s analysis finding that scores often drop during these transitions but rebound once members adjust. That temporary decline does not mean the initiative failed as some of the highest-performing credit unions see stronger scores after recovery, once the improvements are fully realized.

Acknowledging that dynamic when setting annual goals can prevent frustration among staff and leadership alike, while keeping teams focused on long-term impact rather than short-term fluctuations.

Turning Feedback into Action

Setting smart goals is only the first step. Acting on the insights behind the data is what drives lasting loyalty. Credit unions that regularly review survey results, adjust based on feedback, and celebrate progress at every level see stronger engagement, both internally and with members.

When MX is treated as a side project or an annual score, it fails to connect daily service to the credit union’s mission and long-term growth. As credit unions prepare for the year ahead, the focus should be on turning feedback into a strategic advantage that deepens member relationships and builds lasting trust.

Michelle Bloedorn is CEO of Member Loyalty Group, a provider of member experience analytics and strategic support exclusively for credit unions, including the 2026 MX Goal Setting Guide.