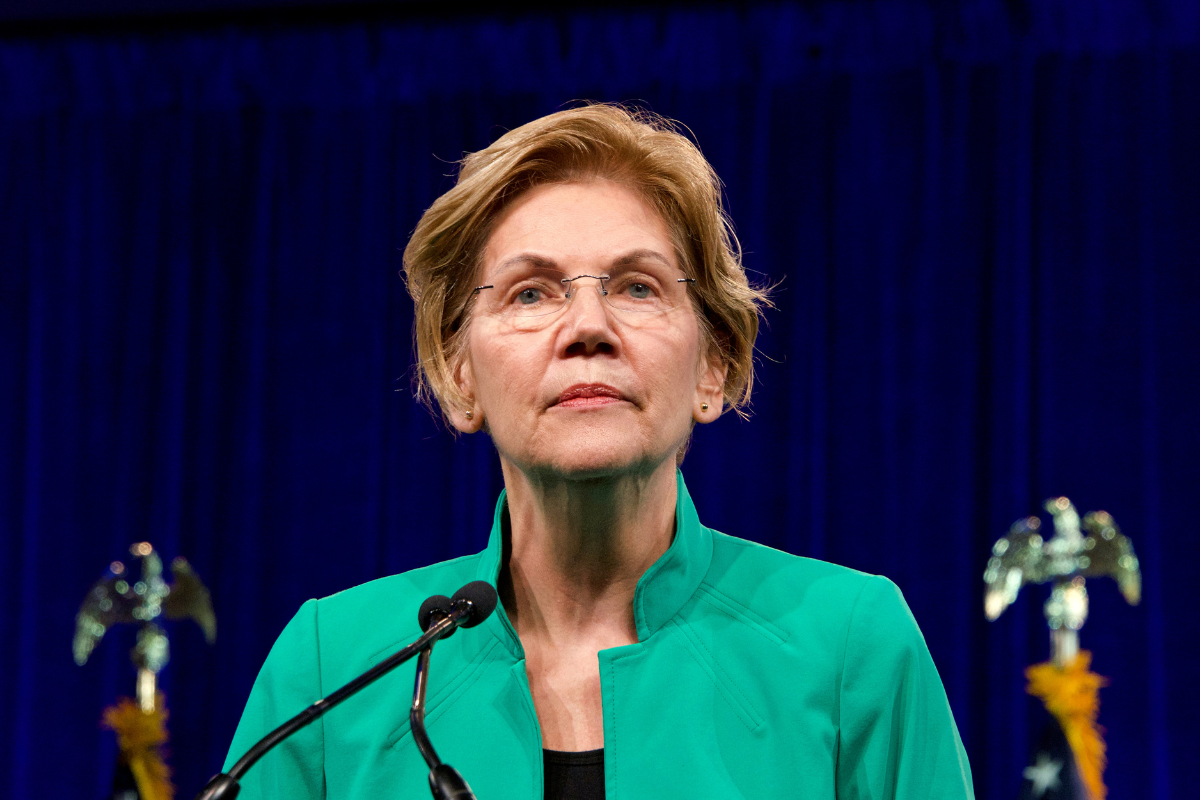

This week, Senators Elizabeth Warren (D-MA), Cory Booker (D-NJ), and Richard Blumenthal (D-CT) sent a letter to 21 credit unions across the country requesting extensive information about overdraft and non-sufficient Funds (NSF) programs.

While much is said about what credit unions charge, far too little is said about what credit unions prevent. Overdraft programs are an optional safety-net service that millions of Americans actively choose because the alternative is often worse: bounced rent checks, utility shutoff notices, damaged credit, or having to turn to high-cost lenders.

Credit unions are member-owned, not-for-profit institutions that design these programs to cushion short-term cash-flow gaps, not to trap people in debt. They pair overdraft services with small-dollar loan products, real-time alerts, financial counseling, fee caps, and grace periods precisely because their mission is to improve members’ financial well-being. In a moment when households are navigating unprecedented volatility in expenses and income, eliminating or mischaracterizing overdraft protection risks taking away one of the few guardrails that actually works for working families.

Credit unions’ people-first focus is exactly why overdraft protection, often referred to as Courtesy Pay, is designed to shield people from far more damaging consequences during emergencies or unexpected expenses. Without it, a parent facing a temporary shortfall could see a grocery or gas transaction declined, a rent payment returned, or a utility bill go unpaid—problems that spiral quickly into late fees, service shutoffs, or even eviction. Courtesy Pay is not a revenue strategy; it is a member-requested safety net.

When credit unions have surveyed their members, the response is clear. Members want access to these financial tools and often rely on their credit union to have their back in difficult situations instead of using predatory third-party service providers.

Credit unions structure these programs intentionally to protect—not penalize—members. They are voluntary, requiring members to opt in; transparent, with clear and plain-language disclosures; and used only when necessary, supported by financial education and counseling. Each program is thoughtfully tailored to the needs of the credit union’s membership and community.

“Credit unions are owned by our members. Every decision made centers on protecting members’ financial stability, not jeopardizing it,” said Samantha A.M. Beeler, President of The League of Credit Unions & Affiliates. “A program such as Courtesy Pay is just one of the tools that helps people avoid greater financial harm during life’s unexpected moments.”

Across Alabama, Florida, Georgia, and Virginia, payday lenders cluster heavily in communities with limited access to financial services, targeting families who are already trying to make ends meet. Eliminating access to overdraft protection would push thousands of people directly toward these predators, whose interest rates can exceed 300% APR.

The League is dedicated to continuous engagement with lawmakers to ensure they fully understand the credit union mission to expand financial opportunity, strengthen financial well-being, and uplift the communities we serve.