By James Chemplavil, Founder/CEO, Salus

Credit unions are in the thick of strategy and planning for 2026 and beyond. And that focus will inevitably turn to identifying ways to win with Gen Z.

This focus makes sense. By some estimates, Gen Z will be the largest adult generation in the U.S. in five years. And while everyone has ideas, best practices are hiding in plain sight. Three fintechs (Dave, Cash App, and Chime) have emerged as early winners for Gen Z market share in financial services. So, what can credit unions learn from these fintechs to sharpen next year’s strategic priorities?

Sizing Up Fintechs

To identify viable strategies, credit unions should study the best-of-breed fintechs that win with Gen Z. Dave, Cash App and Chime are worth considering for a few reasons.

- Dave has 2.8 million active members, Cash App has 8.3 million active members and Chime has 9.1 million active members. All three would be a top-five credit union based on the size of their membership, and all three are growing by over 10% per year.

- 75%-88% of the people who use Dave, Cash App and Chime are Gen Z or millennials. By contrast, the average credit union member is 53 years old.

- All three companies report financial results and discuss them publicly every quarter, sharing key insights into how they achieve their performance.

With these thoughts in mind, let’s look at these three fintechs to see what drove their Gen Z growth.

Dave’s acquisition strategy: “Achieve highly efficient customer acquisition costs by addressing members’ most crucial need – liquidity – and then deepening into long-term banking relationships.”

Dave

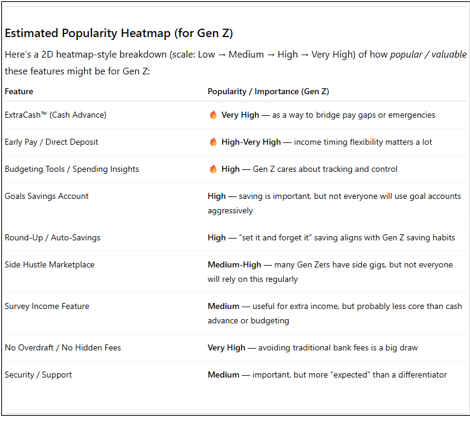

Dave started as an app that offered consumers a way to avoid costly overdraft fees. But the fintech has built out a more robust banking offering by listening to the needs of its younger members. Per ChatGPT, these are the most important features that attract Dave’s Gen Z members:

The generative AI response highlights ExtraCash, a short-term liquidity product, as the most important feature among Dave’s offerings. This shows up in the real world. Dave’s third-quarter results highlighted the value of giving Gen Z a short-term liquidity solution to deepen member relationships:

- Monthly transacting members grew 15% versus prior year to 2.8 million members.

- Dave members utilized $2 billion in ExtraCash advances (short-term loans of up to $500), an increase of 47% versus the prior year.

- Dave’s acquisition strategy: “Achieve highly efficient customer acquisition costs by addressing members’ most crucial need – liquidity – and then deepening into long-term banking relationships.”

Cash App

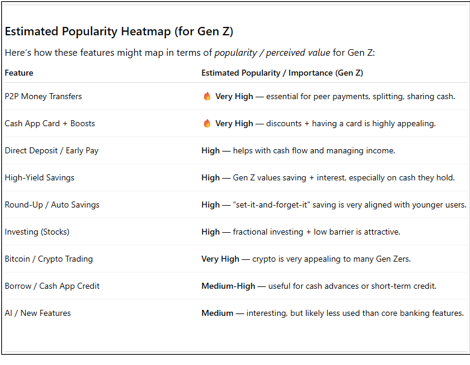

A lot of people don’t realize that Cash App has moved far beyond a peer-to-peer payments app. The fintech has added key products and services to its offerings over the years to attract younger consumers. It now boasts 8.3 million members who direct-deposit their paychecks into Cash App – a larger membership base than every credit union except Navy Federal. Using the same ChatGPT prompt gets the following list of features that attract Cash App’s Gen Z members:

ChatGPT ranks Cash App Borrow, their short-term liquidity product, as a relatively good product. But Cash App’s third quarter results showed it’s much more important to the company’s strategy:

- Primary banking active members grew 18% versus prior year to 8.3 million members.

- Members used an estimated $5.5 billion in Cash App Borrow (short-term advances of up to $500), with originations increasing 134% versus prior year.

- Company commentary on performance: “In the third quarter of 2025, we continued to prudently invest in our lending products, including growing Cash App Borrow given the strong unit economics and returns we have seen.”

Chime

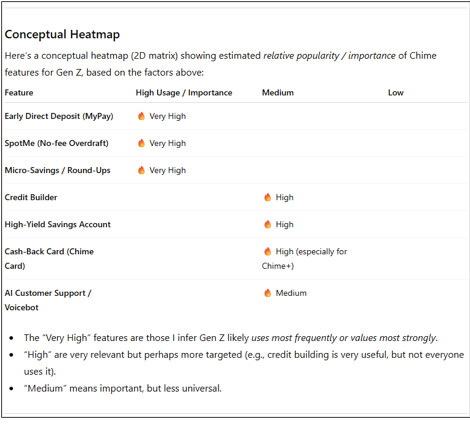

Chime is the poster child for the fintech entrant that credit unions fear is taking Gen Z members, boasting over 9 million active members. They’ve built an impressive consumer-focused brand in financial services. Beyond their marketing campaigns, what products and services are driving people to the neobank? Here’s the answer from ChatGPT:

Once again, a short-term liquidity product, MyPay, tops Chime’s list of important products for Gen Z users. The company’s third-quarter results reflected the importance of this product to its overall growth strategy:

- Active members grew 21% YOY to 9.1 million members.

- Members used an estimated $3.9 billion in MyPay advances (short-term cash advances up to $500).

- The company’s outlook on winning Gen Z? “We continue to strengthen our short-term liquidity offerings, leveraging our rich data and privileged repayment position as members’ primary account.”

Fintech Takeaways for Credit Unions’ 2026 Strategy? Short-Term Liquidity Solutions

Dave, Cash App, and Chime are wildly successful fintechs with Gen Z. While they all offer slightly different products and services to attract and retain members, the common thread is that all three provide a seamless automated solution for short-term cash. Their solutions drove member growth and deeper member engagement, so much so that all three highlighted short-term liquidity solutions as core to their growth strategy.

Credit unions can learn a few things from this:

- Meet Gen Z where they are, giving them an accessible solution to a problem they face.

- Partner for solutions that aren’t built on traditional underwriting, but on modern strategies that enable more approvals without adding excess risk.

- Make it digital and available 24/7; Gen Z will come with their direct deposit relationship to use your credit union’s short-term liquidity product.

You can read more about Dave’s results, Cash App’s results, or Chime’s results. And if you’re ready to see how you can bring these products to the communities you serve and win with Gen Z, learn more about partnering with Salus.